Limited Time Opportunity

Maximise Profit | Minimise Risk

Please watch finish this 7 minutes video

Real case studies

2 case studies to show the amount of additional PROFIT the buyers can make when they fully understand the concept and make the RIGHT choice for their property purchase.

✅ How to spot the RIGHT new launch property to buy in today's over saturated market?

✅ Is MRT the only deciding factor when come to property investment?

✅ What is the pricing co-relation over a period of time?

✅ A secret to lower RISK and increase your Capital GAIN.(Proven)

✅ When do you buy Freehold over Leasehold property and is a SURE Win choice?

✅ Is project size play an vital role in captial appreciation?

✅ You can duplicate the success in today's market

I Want to understand further

Showcasing 2 Real Case studies

Disclaimer: Both projects are good project but is the time of entry and price that make the different

This buyer make more than 20% profit by making the RIGHT choice in 2011.

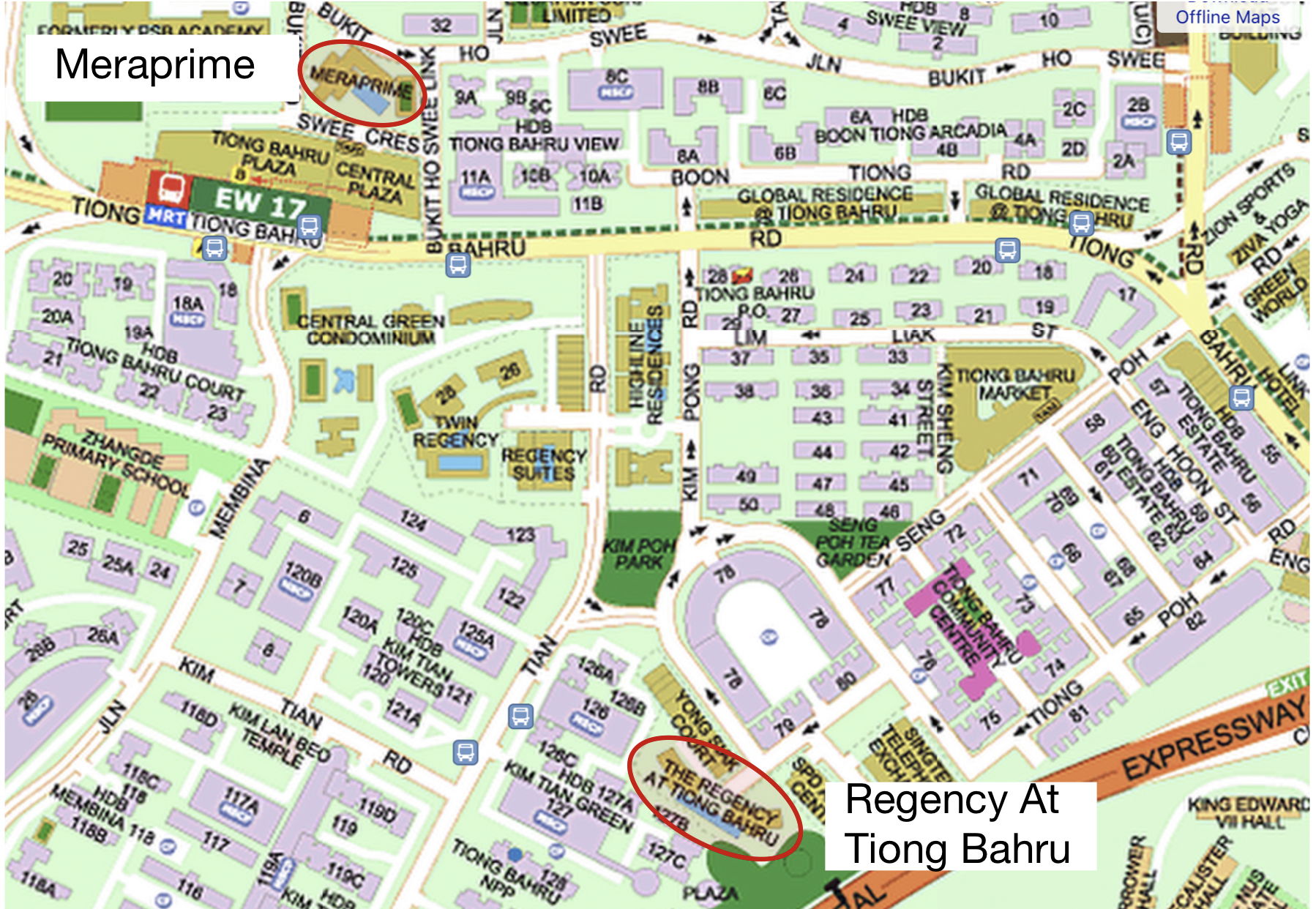

1st Subject property is located at Tiong Bahru. It highlights the historical trend where freehold properties have shown remarkable long-term appreciation. In this case, the buyer opted for Freehold Regency At Tiong Bahru in 2011 have witnessed a substantial profit advantage compared to if they were to choose 99-year leasehold Meraprime.

This demonstrates how investing in freehold properties at the right timing with the right price can be a lucrative decision over time, and it's a testament to the enduring appeal and value of freehold real estate.

The interesting point to note here is that the location of Meraprime is very close to Tiong Bahru MRT station compare to The Regency At Tiong Bahru. (See the map below)

Despite this, The buyer who bought Regency At Tiong Bahru still make 23% more profit when they bought it at the Right Time and Right Price.

2nd case study

This buyer make more than 30% profit by making the RIGHT choice in 2009.

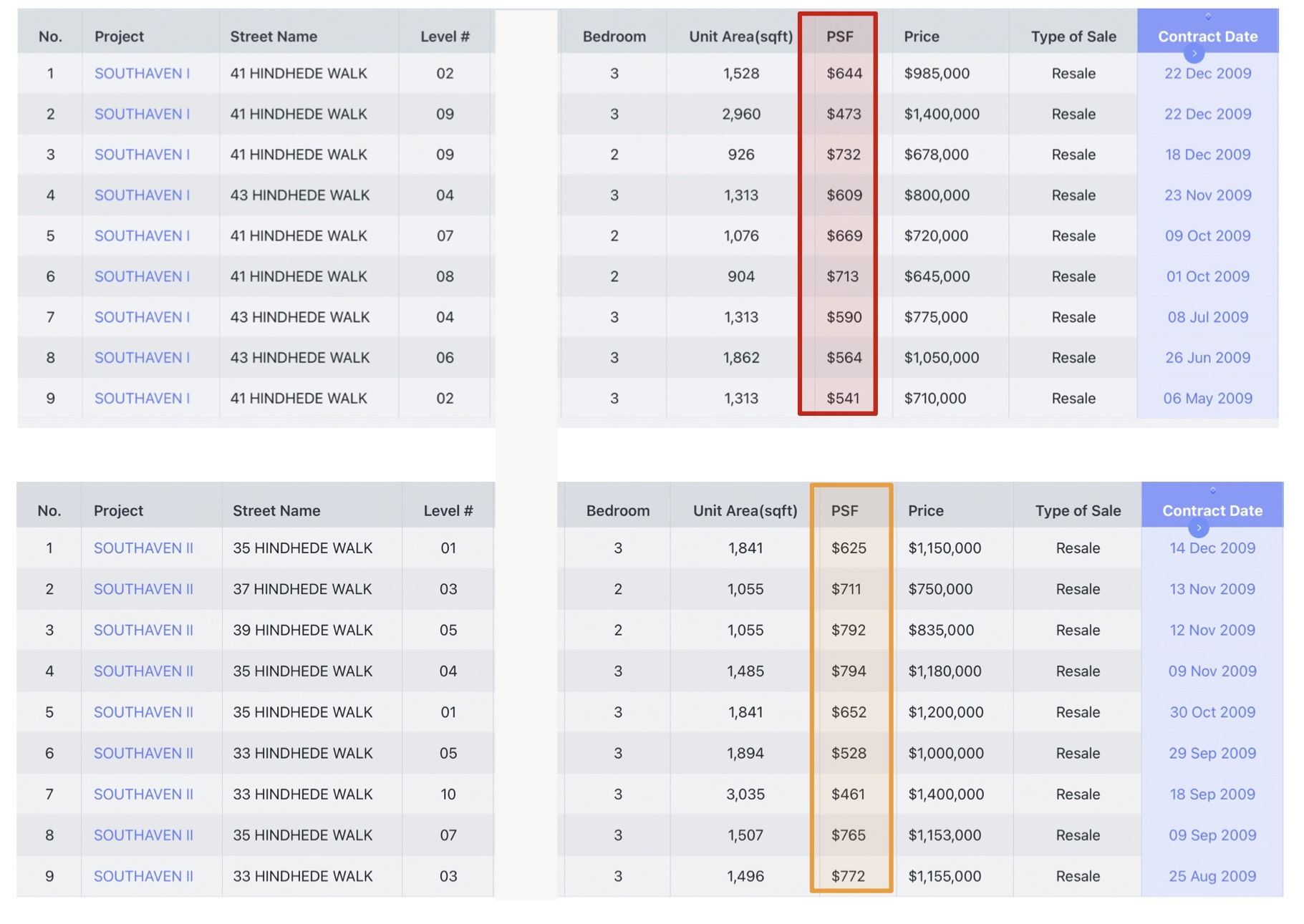

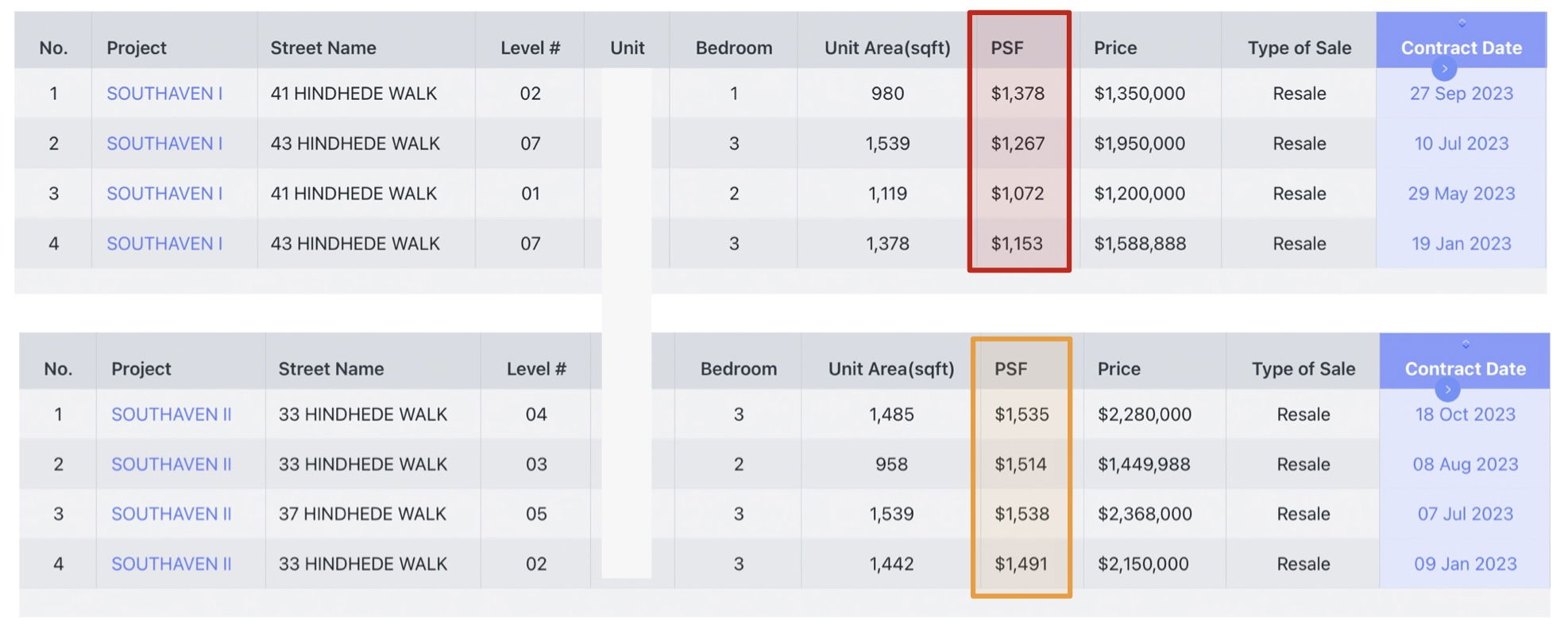

2nd Subject property is located at Upper Bt Timah Road. In this case, the buyer who opted for 999 years Southaven II in 2009 have witnessed a substantial profit advantage compared to if they were to choose 99-year leasehold Southaven I. Both projects are located side by side and TOP year different by 2 years only.

Disclaimer: Both projects are good project but is the time of entry and price that make the different

In the year of 2009, the 999 years Southaven II was selling very close, or cheaper than the 99 years Southaven I. That make buying the 999 years a brilliant choice. And this buyer make a decision to go for the brilliant choice and today they had achieved more than 30% profit compare to if they were to go for the 99 years Southaven I back then in 2009.

Prices of Southaven I and Southaven ll In 2009 (Close to each other)

Prices of Southaven I and Southaven ll In 2023 (Southaven II Sold At So Much Higher Than The Southaven I)

Do You Need More Proven Case Studies To Understand Further?

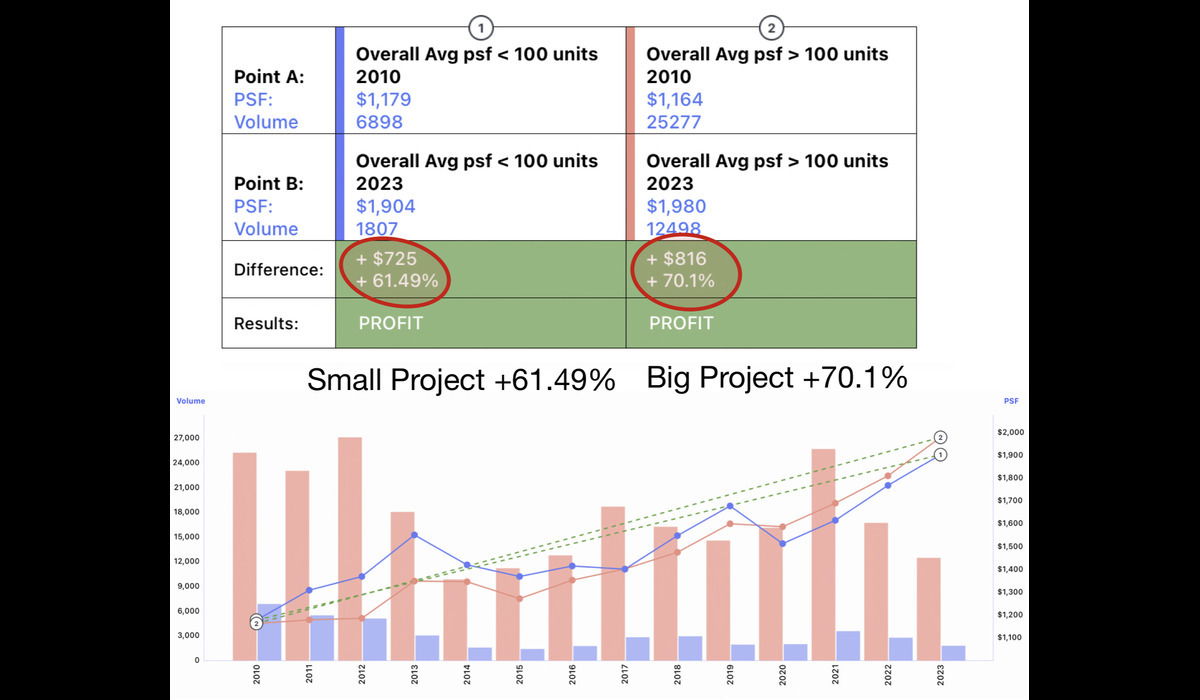

The chart below shown an overall property's average psf in Singapore for those developments that are below and above 100 units. The result shown that development with more than 100 units appreciated more in the same period of time compare to those that are below 100 units developments.

You can ask me for more comparison!

🎯 Freehold Big development compare to Freehold smaller developments

🎯 Freehold Big developments compare to 99 yrs Big developments

🎯 Compare in different districts

This is to ensure that your Money invested is working harder for you.🏦🏦🏦

Freehold Supply is depleting

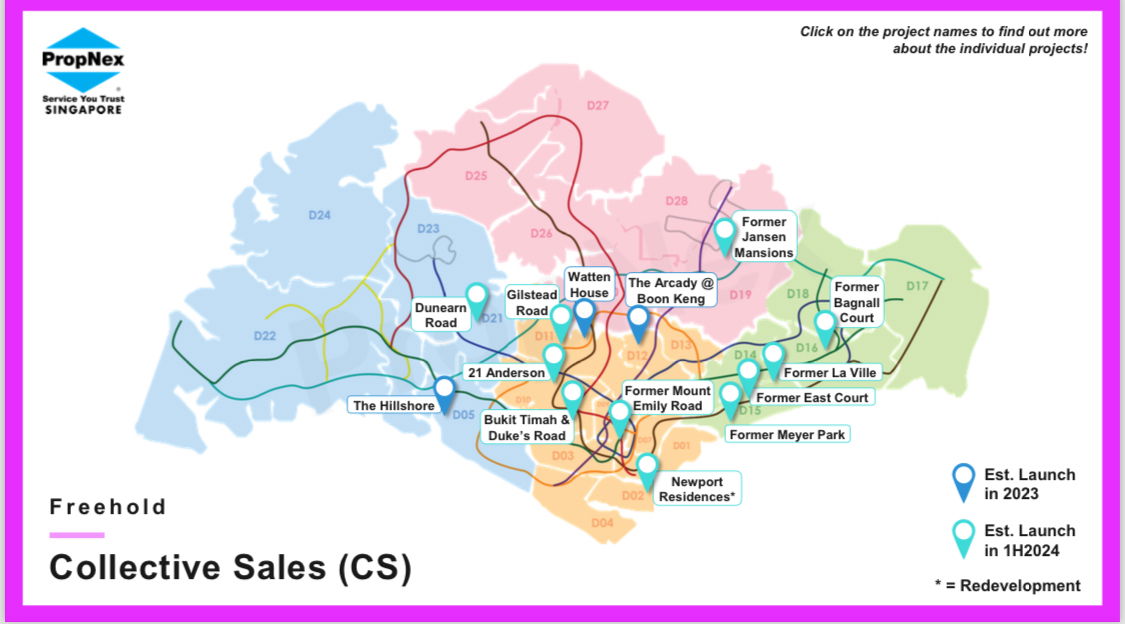

In the next 2 years, the FH market might see a drought in new launches. So, what's the impact on FH property prices?

Check out the upcoming Freehold successful enbloc projects launching this year and next. They're mainly smaller scale projects, and after that, FH projects might be a rarity. But one thing's for sure, pricing will be on the rise.

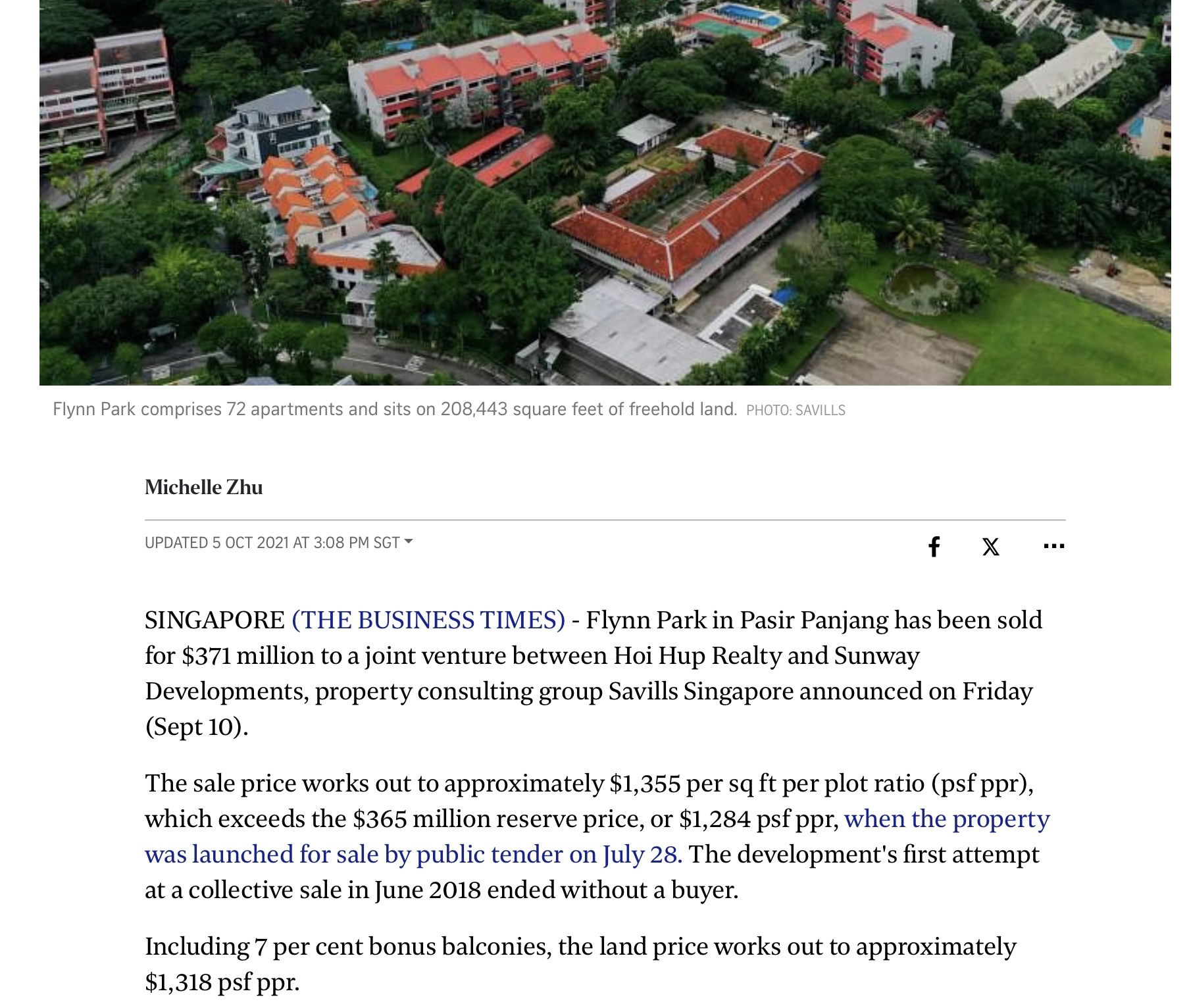

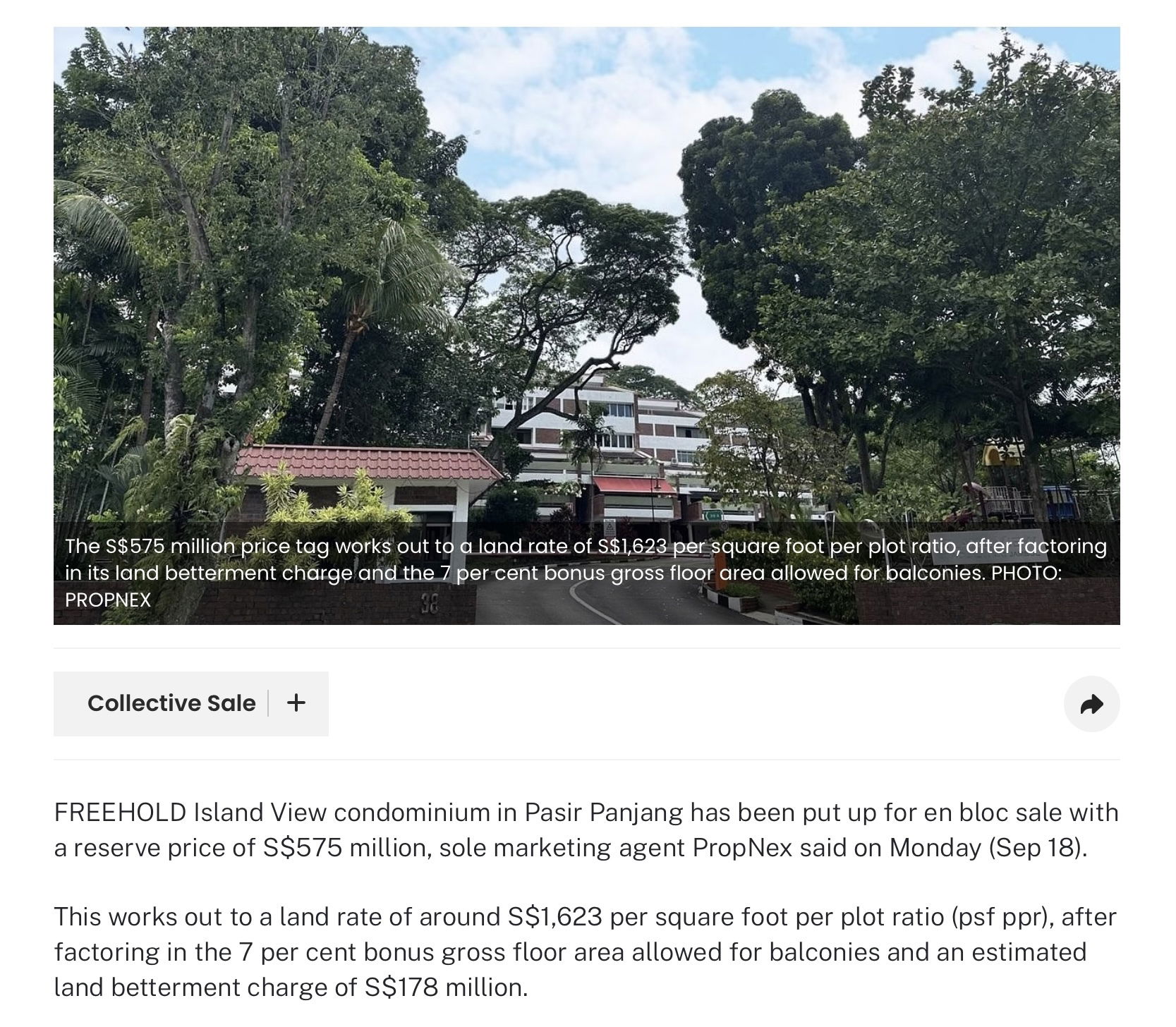

Take, for instance, Island View condo, now under enbloc tender. Compare it to Flynn Park in the same location enbloc in 2021: $1,623 psf ppr for Island View vs. $1,318 ppr for Flynn Park. That's just a 2-year time difference!

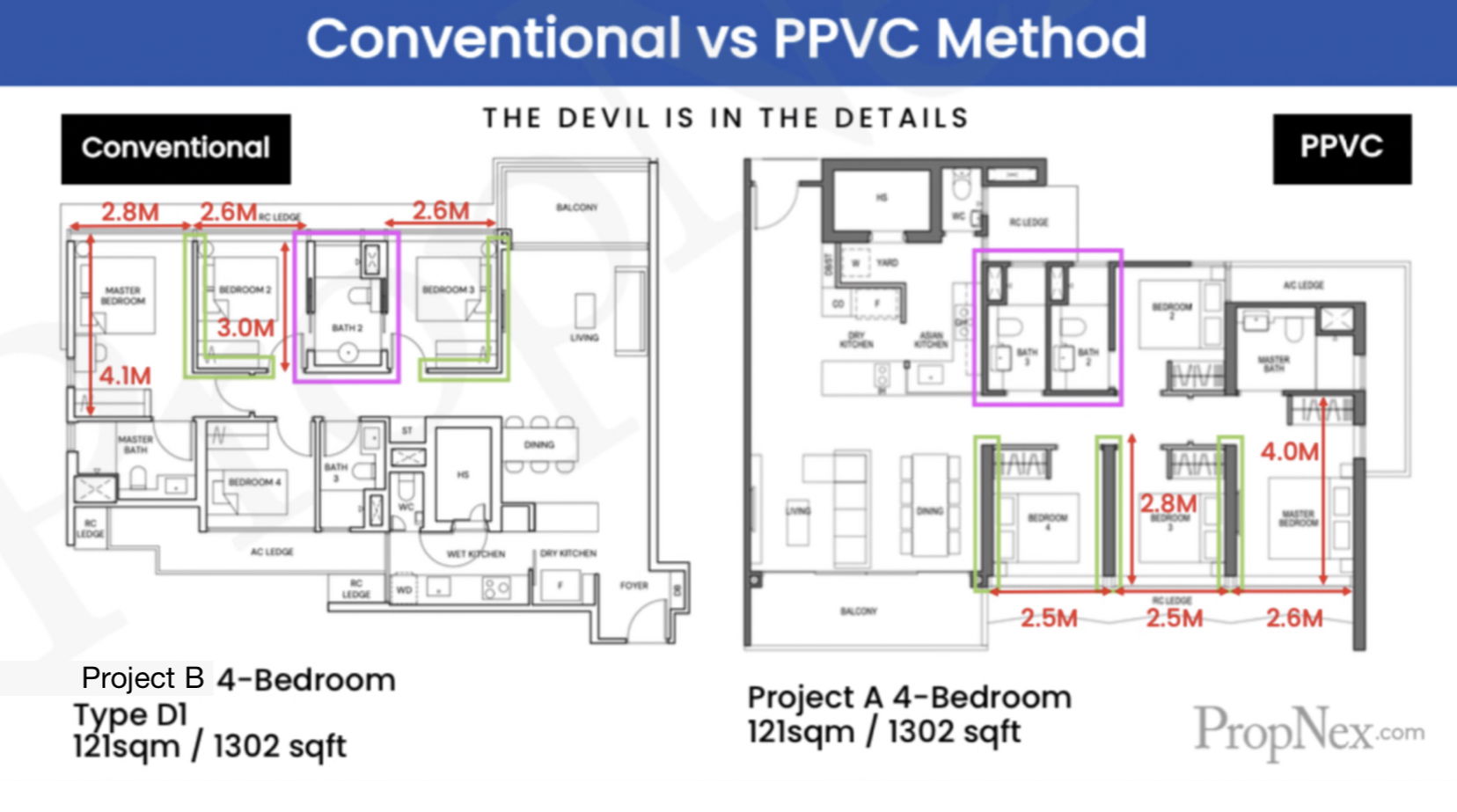

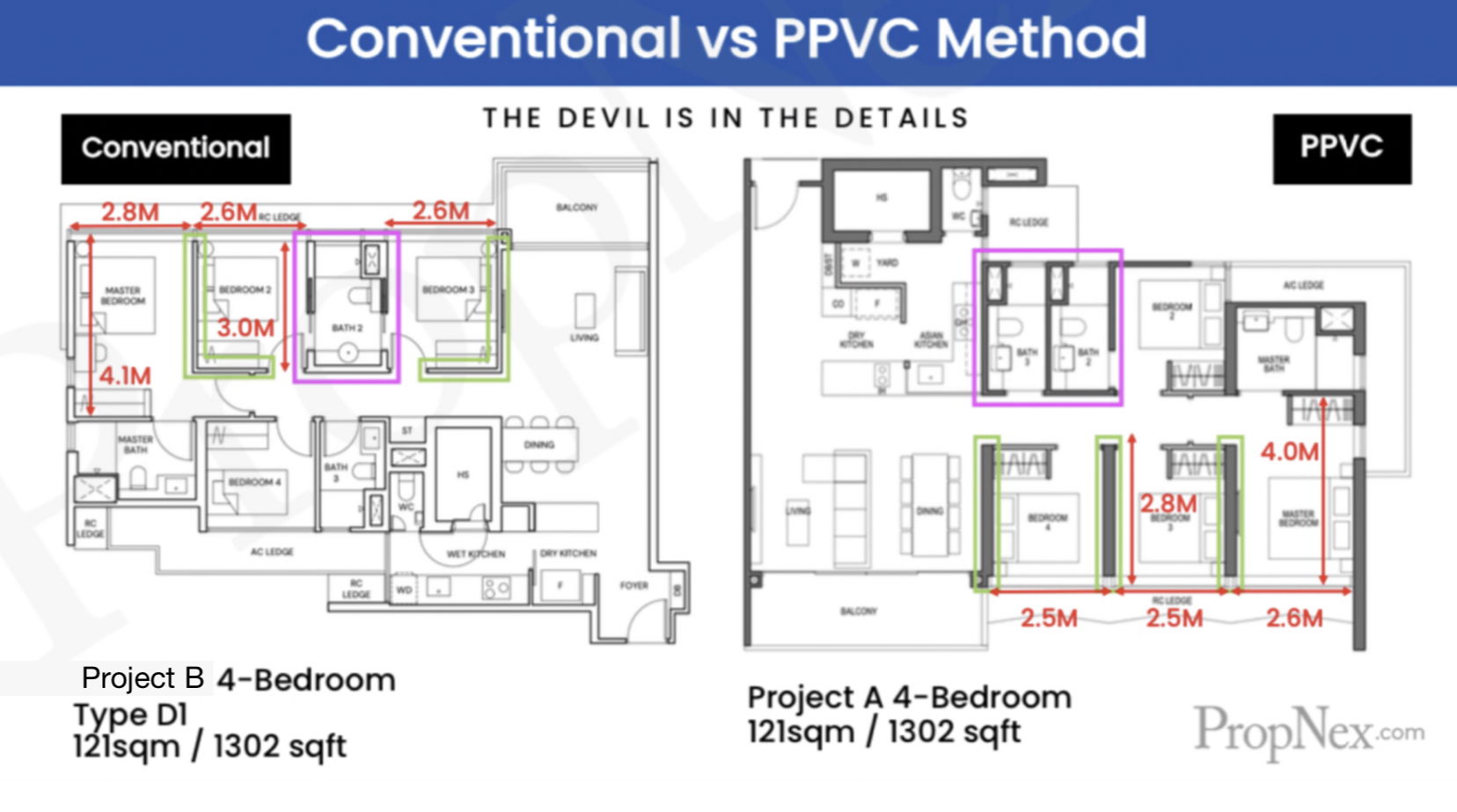

Conventional construction method’s advantage

PPVC and Non PPVC Different

Nowadays, with the increasing projects having PPVC construction method which don't allow to hack the walls. The flexibility to reconfigure the unit layout is a significant advantage. This flexibility allows residents to adapt their living spaces as their needs change over time, such as when family size increases or decreases. It also opens up the possibility of catering to a broader range of potential buyers in the future who may have specific layout preferences that are not easily found in other developments. The ability to customize the layout to suit individual preferences can be a compelling selling point in the future.

We believe that this article has added value by shedding light on the intricacies of property appreciation and the diverse factor influencing it.

Our aim is to equip you with the knowledge you need to navigate the real estate market with confidence.

If you are keen to find out where are the opportunity now having the same situation like the above 2 case studies, feel free to get in touch with Jip. Thank you for your time, and may your property investment journey be a successful and fulfilling one.

About jip ng